Ever wondered how to be your own bank with whole life insurance?

Not many high-income earners know about this exclusive approach to becoming one’s own bank with whole life insurance.

Learning how to be your own bank with whole life insurance involves leveraging the cash value in a properly funded life insurance policy to create an alternative source of financing for you and your family or business.

This is known as the infinite banking concept and it allows you to bypass traditional lenders, giving you greater control over your cash flow.

Studies show, only about 54% of Americans have some type of life insurance coverage. This indicates that there’s a significant gap in understanding the benefits these policies offer beyond just death benefits.

The reality is, when done correctly, using life insurance as your personal bank can work….but it doesn’t always work (more on that later).

In this blog post, we’ll guide you on how to be your own bank with whole life insurance while also maximizing its potential for tax-free growth and guaranteed returns through proper funding strategies and riders like Paid-Up Additions (PUA).

Dive in to learn more…

Table of Contents:

- Understanding the Infinite Banking Strategy

- Leveraging Equity in Your Personal Bank

- Benefits of Using Cash-Value Life Insurance Policy as Personal Line of Credit

- Enhancing Attractiveness with Paid-up Additions (PUA) Riders

- Understanding Financial Obligations Before Embarking on Such Strategies

- FAQs in Relation to How to Be Your Own Bank With Whole Life Insurance

- Conclusion

Understanding the Infinite Banking Strategy

Welcome to the world of Infinite Banking, a financial strategy that allows you to be your own bank. This is a unique tax strategy and alternative investment that high-income earners can benefit from.

So, how does it work?

Setting up your own ‘banking engine’ with Whole Life Insurance

You can set up your own banking system by taking out a whole life insurance policy and paying extra premiums over and above the basic coverage amount. This increases the guaranteed cash value of your policy while also providing access to larger future dividend pools. This isn’t just about death benefits; this is about creating an alternative banking system for yourself.

Most of these policies will be implemented by a mutual life insurance company and will always be a form of permanent life insurance. Term life insurance has no savings accounts and therefore has no way to make a policy loan.

Overfunding for increased cash value and dividends

Properly funding these mutual insurance company whole life policies is a must, and when done right can be a long term good investment. The more you put into it, the more you get out. Overfunding leads to higher cash values and dividends, turning your policy into a powerful financial tool.

Overfunding your policy is simply another way of saying the goal should be to maximize cash and minimize fees.

You should know….If you choose a mutual insurance company, the cash will have a guaranteed rate of return, but the guaranteed rate will not be enough to both support the permanent coverage for life AND generate a consistent policy loan. The guaranteed rate for most permanent coverage whole life policies is around 1% which is not enough to both pay interest and cash flow.

This does not mean the strategy cannot work….It simply means it will not be guaranteed to work. Guarantees are expensive, risk is free.

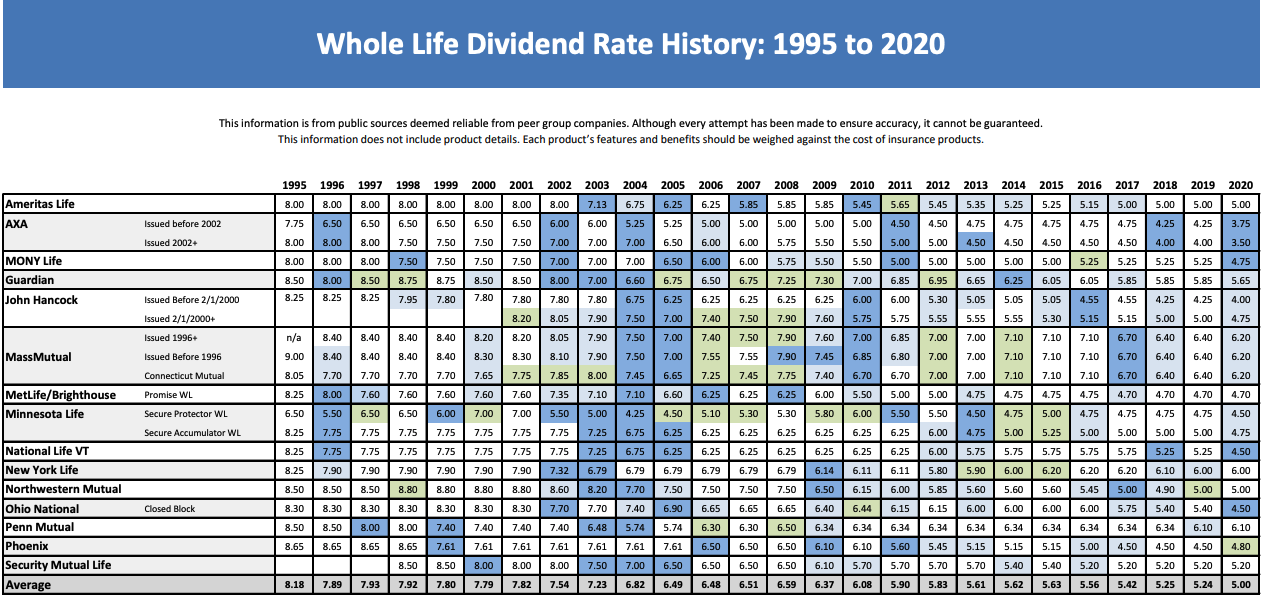

You life insurance cash growth in a mutual life insurance company will be declared annually, is subject to change, and has averaged between 3.5-5.5% after fees.

You can see a chart below of dividend history listed by company (this chart does not show the internal rate of return as these figures are before fees and you should do your own research).

Any properly designed policy will include the use of paid up additions and might also blend in some non commissionable insurance to further reduce thew fees. We will talk more about PUA riders later, but know that a comprehensive conversation in this medium is impossible. To dive deeper on PUA riders and other ways to reduce fees will require an in-depth one on one conversation.

Leveraging Equity in Your Personal Bank

Alright, so you’ve got your ‘banking engine’ all set up with a well-performing whole life insurance policy. Now what?

You’re about to unlock the power of leveraging equity from this personal bank.

Borrowing against Cash Surrender Value

Your first move? Borrow against your cash surrender value. This is like tapping into a gold mine that’s been sitting right under your nose.

The beauty here lies in the flexibility it offers – you can make principal and interest payments on any schedule desired or pay nothing until able to make a balloon payment. And yes, some policies even offer minimum required loan payment features.

Flexible Payment Schedules

Having the ability to control when and how one pays back a loan is invaluable, enabling greater flexibility than traditional loans offer. Whole life insurance policies, unlike traditional loans, allow for incredibly flexible repayment schedules. The aim here is not only to leverage but also manage this asset effectively while enjoying its benefits.

Benefits of Using Cash-Value Life Insurance Policy as Personal Line of Credit

Let’s talk about the perks of using a cash-value life insurance policy as a personal line of credit. The biggest one? Tax-free growth within permanent policies. Unlike term policies that provide coverage only for set periods, cash-value policies are here to stay.

One of the most significant advantages of a cash-value policy is the tax-free growth within permanent policies. The taxman can’t touch your cash value growth in a whole life policy. No problem – the IRS won’t get a cent of your cash value increase in a whole life policy (assuming you are working with someone who knows what they are doing and properly structures your contract).

Are rising interest rates making borrowing money less affordable from traditional sources? No worries. Whole-life policies come with their own lifeline – low-interest loans from mutual insurers (potentially…life insurance companies each set their own rates of borrowing). Mutual insurers have got you covered (literally and figuratively). They offer lifelong coverages at attractive rates compared to those pesky banks, credit card companies, and other financial institutions.

Having the right coverage in place can give you peace of mind and provide access to your wealth when necessary. With a whole life insurance policy acting as your personal line of credit, financial freedom is truly at your fingertips.

This Sounds Too Good To Be True!

Well yeah! We haven’t talked about any of the draw backs yet!

So far I’ve told you you can borrow against your permanent life insurance, maximize your cash, and paying interest back is flexible and optional?

How?

Well, you don’t actually loan money “out of your own policy.”

You also aren’t “paying interest” back to yourself.

Your policy loans are actually taken from the life insurance companies themselves and they aren’t simply loaning you money for free! The second you take a loan AGAINST your policy, the mutual insurance company places a “lien” against both your cash value and your death benefit.

If you cancel your coverage, your cash FIRST goes towards paying back the loan plus you pay interest BACK TO THE COMPANY.

If you die, your death benefit FIRST goes towards paying back the loan plus you pay interest BACK TO THE COMPANY.

So you see, the company is more than willing to let you use your policies as savings accounts that generate tax free cash flow because they know they will be paid back with interest either when you cancel the policy or die. You aren’t getting anything for free.

This wont work with short term goals.

This wont work if you don’t have discretionary cash flow.

This wont work if the mutual companies or life insurer you have chosen to work with reduces rates to the guaranteed minimum.

This wont work very well if your policy is structured poorly (designed for maximum commissions vs maximum cash growth).

This wont work if you make 2 premium payments and decide the strategy isn’t for you.

This wont work for you if it is your only source of liquidity.

Enhancing Attractiveness with Paid-up Additions (PUA) Riders

Have you heard of PUA riders?

PUA riders are handy little additions that allow you to purchase extra death benefits, which means more cash value for you. This is a game changer when compared to a policy where all of your premiums are going towards purchasing base insurance. It’s like having your cake and eating it too.

But that’s not all. By leveraging PUA riders effectively, you can not only increase your policy’s cash value but also its future dividend potential. It’s a win-win situation.

If you’re interested in adding PUAs to your policy, simply reach out to us. We will be able to provide assistance throughout the procedure.

Understanding Financial Obligations Before Embarking on Such Strategies

Let’s face it, the Infinite Banking Concept isn’t a walk in the park. It requires a solid understanding of your financial commitments and clear goals.

Be certain of what you’re agreeing to. The premiums aren’t exactly pocket change, and there are potential liquidity risks involved with this strategy. Especially in the early years.

In fact, I’ll just go ahead and excuse half the room now. Buying permanent life insurance to generate cash flow in the short term (think years 1-4) is NOT a good investment. To truly maximize cash you must give the policy time to grow and you need to get out of the first few years where fees are high and eating aways at your available dollars.

The Cash Flow Banking mechanism, offered by top-dividend-paying companies, provides flexibility but also comes with its own set of obligations.

This isn’t some get-rich-quick scheme or a loophole that only finance degree holders can exploit. This is about setting realistic financial goals and making informed decisions based on those goals.

If done right, you could create an alternative banking system using whole life insurance policies from mutual insurers offering lifelong coverage at low-interest rates compared to traditional lenders. Now that’s something worth considering.

FAQs in Relation to How to Be Your Own Bank With Whole Life Insurance

How to Use Whole Life Insurance as Your Bank?

Overfund your Whole Life Insurance policy to increase cash value and dividends, then borrow against the Cash Surrender Value.

How to Use Whole Life Insurance for Infinite Banking?

Utilize the accumulated cash value of your Whole Life Insurance policy as a personal line of credit for Infinite Banking.

How to Make Money with Whole Life Insurance?

Earn money through Whole Life Insurance with tax-free growth, low-interest loans, and Paid-up Additions (PUA) riders that increase death benefits.

How Much Whole Life Insurance Do Banks Own?

Banks hold substantial amounts in Bank-Owned Life Insurance (BOLI), but the exact figures vary depending on the institution’s size and strategy.

Other Types of Life Insurance Beyond Whole Life

- Term Life Insurance: Provides coverage for a specific period, typically 10-30 years.

- Universal Life Insurance: Offers flexibility in premium payments and death benefits.

- Variable Life Insurance: Allows policyholders to invest in sub-accounts, similar to mutual funds.

Investment Strategies Not Related to Whole Life Insurance

- Stocks and Bonds: Traditional investments that offer potential for growth and income.

- Real Estate: Can provide rental income and appreciation in value.

- Retirement Accounts: 401(k)s, IRAs, and other retirement accounts offer tax advantages and long-term growth potential.

Conclusion

High-income earners can become their own bank and generate significant cash flow with permanent life insurance and the infinite banking strategy.

Set up a ‘banking engine’ by overfunding and leveraging equity in personal banks gives you access to flexible payment schedules, low-interest loans from mutual insurers, and can release you from dealing with unscrupulous financial institutions.

A properly designed policy will Increase cash growth inside your cash-value life insurance policies with paid-up additions (PUA) riders.

Before embarking on such strategies, evaluate financial commitments and goals to take control of your finances and make sure you can commit to become your own bank with whole life insurance over the long run.

You now know enough about how to be your own bank with whole life insurance to be dangerous. For more information on the infinite banking strategy, start a conversation with us here: